Welcome to Durham University Business School

University of the Year 2026

The Times and The Sunday Times Good University Guide

A Top Global Business School

Durham is an international triple accredited business school. Founded in 1965, we are one of the UK's longest established business schools and are proud to be integral to Durham University.

Sharing insights, supporting innovation and teaching tomorrow’s leaders. We believe that to succeed in business, you need to get closer to the realities of business - so that’s what we do. We combine our academic excellence, insightful research and exceptional global business connections, to equip our students and alumni to become innovative business thinkers of the future and an influential individual in and beyond their careers.

A globally outstanding centre of teaching and research excellence, a collegiate community of extraordinary people, and a unique and historic setting – Durham is a university like no other.

-172x145.png)

.png)

Focus Programmes

MSc International Business

The MSc International Business programme takes a global perspective to prepare you to successfully negotiate the realities of management in an international setting.

Accounting Analytics and Sustainability (Online Executive)

Delivered fully online, in a part-time study format, our new MSc in Accounting Analytics and Sustainability (MAAS) in an executive-level programme.

60th Anniversary

In 2025, Durham University Business School proudly marks 60 years of excellence in business education, research, and impact. Since our founding in 1965, we have shaped generations of leaders, advanced groundbreaking research, and built a strong global community.

Gain a world-class education at a global business school

Our programmes combine academic excellence and outstanding research with global business connections. Add to that, exceptional skills and career development opportunities, you will find a learning experience that equips you for success in your chosen career.

MBA

Masters

Undergraduate

DBA and PhD Programmes

Our three DBA programmes offer experienced business managers and executives the opportunity enhance business and career knowledge. The Durham PhD enables you to combine rigorous academic theory with research to influence the world of business and make a unique contribution to your field of study.

What's new?

Farmers and supermarkets worry that extreme weather will stop food getting to consumers – here’s what needs to change

Mohammed Alzuhair, Doctor of Business Administration candidate and researcher at Durham University Business School, examines how recent storms have exposed the vulnerability of the UK’s food supply chain.

New partnership to boost research-led policy

New report calls for coordinated action to tackle economic inactivity

Shaping the Future of Aviation: An Interview with UK Forty Under 40 Winner, Tariye Orianzi

Global recognition for innovative teaching

Reflecting on COP 30

The UN Global Compact at COP30: Ousting the ghost of organisational green and social washing

Farmers and supermarkets worry that extreme weather will stop food getting to consumers – here’s what needs to change

Mohammed Alzuhair, Doctor of Business Administration candidate and researcher at Durham University Business School, examines how recent storms have exposed the vulnerability of the UK’s food supply chain.

Expertise informs Parliamentary report on space

Mobile clinics improve health outcomes and cut costs in developing countries

Could your boss be lonely? Here’s why it matters more than you might think

Loneliness at work is often invisible, yet it can have powerful effects on leaders and organisations. Drawing on their research, Janey Zheng and Olga Epitropaki from our Business School, alongside Karolina Nieberle from our Department of Psychology, explore why managers experience loneliness, how it shapes leadership, and what helps prevent it from taking hold.

New report calls for coordinated action to tackle economic inactivity

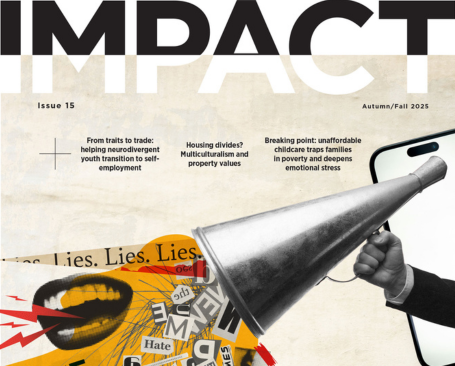

IMPACT Magazine Edition 15 launches

Upcoming events

Interest Rate Smoothing in the Face of Energy Shocks

'Problematizing Space in International Business Research: Toward a Social Production of Space', a seminar by Professor Emmanuella Plakoyiannaki (University of Vienna)

Access Masters Event - London

Centre for Macroeconomics Policy Mini Workshop

IMPACT Latest Edition

This issue centres on change and transformation, exploring how engaging with opposing viewpoints can drive meaningful progress, the role of AI in human resource management and the challenges of balancing a demanding career with home life.

/prod01/channel_3/business/media/durham-university-business-school/study/masters-programmes/IB-web-page-banner-950X300-no-name.png)

/prod01/channel_3/business/media/durham-university-business-school/study/masters-programmes/MAAS-web-page-banner-950X300-no-name.jpg)

.png)

.png)

/prod01/channel_3/business/media/durham-university-business-school/impact/Is-your-home-life-holding-your-career-back-.jpg)

/prod01/channel_3/business/media/durham-university-business-school/impact/Changing-human-resource-management-and-managers-Middle-managers%C3%A2%C2%80%C2%99-rage-against-the-machine.jpg)

/prod01/channel_3/business/media/durham-university-business-school/impact/MIND-your-business.png)

/prod01/channel_3/business/media/durham-university-business-school/impact/I-want-to-believe-the-psychology-of-climate-change-conspiracy-theories---Aarron-Atkinson-Toal.png)

.png)

.png)

/prod01/channel_3/business/media/durham-university-business-school/study/eem-3.png)

/prod01/channel_3/business/media/durham-university-business-school/business-projects/Business-projects--(4).png)

/prod01/channel_3/business/media/durham-university-business-school/events/qs-fairs-/Website-Events-Banners--(3).png)

/prod01/channel_3/business/media/durham-university-business-school/study/individual-course-and-cta-images/L109-Economics-with-Study-Abroad.png)

/prod01/channel_3/business/media/durham-university-business-school/Signposting-500-x-300-px-(6).png)

/prod01/channel_3/business/media/durham-university-business-school/Signposting-500-x-300-px-(7).png)

/prod01/channel_3/business/media/durham-university-business-school/for-business/Finance-dept.png)

/prod01/channel_3/business/media/durham-university-business-school/Signposting-500-x-300-px-(8).png)